| STEP ONE

Have you been processing payroll using ePayroll from January 2013?

If Yes: Skip to STEP FOUR.

If No: Proceed to STEP TWO.

|

| STEP TWO

Manually calculate the value of all pay elements for each employee that are required for IRAS.

|

| STEP THREE

Proceed to Payroll Setup -> IRAS Opening Balance -> Fill up opening balance for missing months.

|

| STEP FOUR

Proceed to File Generation -> Tax Export -> Export the IR8A Form (opens as a PDF File).

|

|

| STEP FIVE

Compare the values shown on the IRAS Form (PDF) with your own manual calculations to see if there is any discrepancy.

If Yes: Skip to STEP SIX.

If No: Skip to STEP TEN.

|

|

| STEP SIX

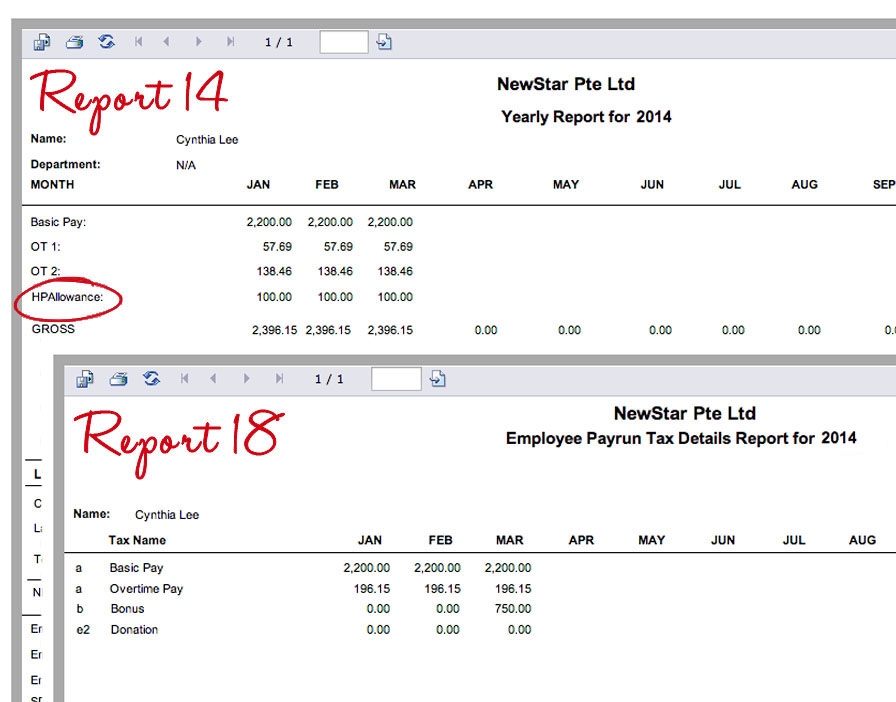

Generate report 18 and 14 for comparison. If certain pay elements in Report 14 are missing in Report 18, it’s because under the tax code has not been tied up for those pay element.

|

|

| STEP SEVEN

In this case, you need to manually calculate the value of each untied pay element for each employee.

|

| STEP EIGHT

Proceed to Payroll Setup -> IRAS Opening Balance -> Fill up opening balance for missing months.

|

|

| STEP NINE

Regenerate Tax Export IR8A Form. Proceed to File Generation -> Tax Export -> Export the IR8A Form. Compare the values in the new IR8A form to your manual calculations.

|

| STEP TEN

If all values are accurate, Proceed to File Generation -> Tax Export -> Export the IR8A Export (XML).

|

|

| STEP ELEVEN

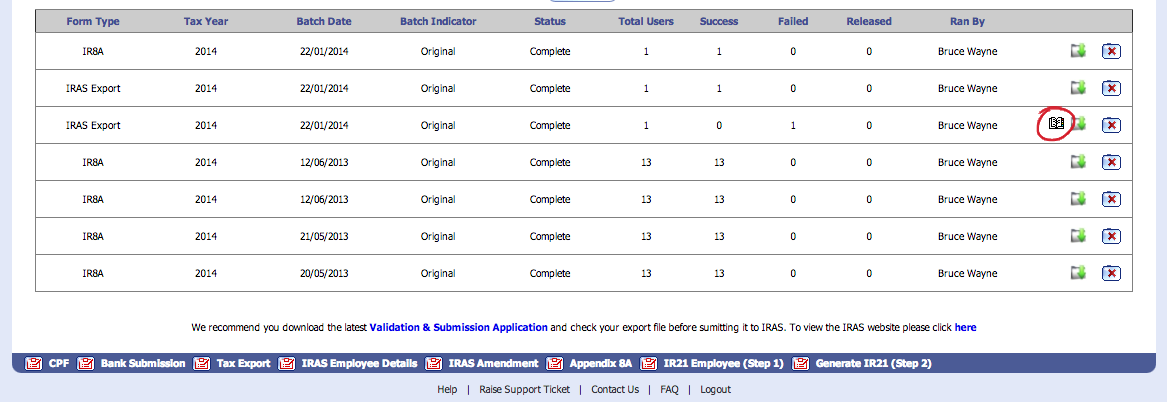

When file generation is complete, click on the book icon to preview any errors.

If there are no errors, click on the download icon.

If there are any errors, rectify them and rerun STEP TEN.

|

|

| STEP TWELVE

Click on Preview File to display a user friendly version of the the XML file. Make sure that all values are accurate.

|

|

| STEP THIRTEEN

Export the XML File. Download the Validation and Submission Application by IRAS to validate the XML File.

If there are no errors, proceed to STEP FOURTEEN.

If there are any errors, fix error mentioned, and repeat step TEN - TWELVE.

|

|

| STEP FOURTEEN

Click on release to release the files to employees. This will let them view it under My Pay.

|

|

| STEP FIFTEEN

Upload XML file to IRAS. To do this, logon to Singpass website and submit the XML file.

|

|

We're dedicated to providing you with the best service and support.

|

Email Enquiries

[email protected]

|

Phone Enquiries

+65 6476 5330

|

Live Chat

Click Here

|

Like Justlogin's Facebook page to keep up with updates on government policy changes, articles on best HR practices and tips on managing your workforce.

|

|